AssetManager Pro 2016 (v5) Release Info

Overview

Information on the GRAGA AssetManager Pro 2016 (v5) upgrade.

Accessing the Upgrade

EXISTING SUPPORT PLAN For those with an eligible and active Support Plan as at the 1st of July 2016 (including those purchased through MYOB) will get GRAGA AssetManager Pro 2016 v5 for FREE, in line with Support Plan benefits and MYOB transitional arrangements. |

NOT ON SUPPORT For those not on support. You can access the upgrade by purchasing a new Support Plan which will give you: 1. GRAGA AssetManager Pro 2016 (v5) 2. 12 months of Technical Support 3. 12 months of Upgrades For additional information please contact GRAGA on +61 3 9016 9454 or email us at sales@graga.com.au |

Upgrading from v1 or v2?

Upgrading from v1 or v2 of AssetManager or AssetManager Pro. Refer to our UPGRADE PAGE on our website for all the details on the key COMPLIANCE and FEATURE changes since the release of those versions over 14 years ago!

Upgrading from v1 and v2 to v5 has also never been easier. Using our new migration services we manage it for you, directly upgrading your file to v5.

Upgrading from v3

Upgrading from MYOB AssetManager Pro v3.X is as easy as opening your existing files in the new version and AssetManager Pro will automatically update your file for use with the latest version.

For full details on the enhancements please refer to the info below on the AssetManager Pro 2015 v4 and AssetManager Pro 2015 v5 release. For full details on the v4 release click here.

Compliance Updates

v5 is a key release for pending compliance changes relating to the 2016-17 year. Again there are a range of changes. Some are new and some further build on (and broaden the application) of key changes introduced in 2015-16.

These include:

- Extension of Small Business Concessions to businesses with up to 10 million turnover (prev. 2 million).

- Updated Luxury Car Tax (LCT) Thresholds

- Updated Motor Vehicle(Car) Depreciation Cost Limits

- Changes in the asset write-off threshold ($6,500 to $1,000) for assets acquired after 1st Jan 2014.

- Changes in accelerated depreciation for Motor Vehicles for assets acquired after the 1st of Jan 2014.

- Changes supporting updates to GST and Depreciation Cost Limits on Motor Vehicles for the 2014 and 2015 financial years.

- 20k Immediate Depreciation for Assets up to 20k effective from the 1st July 2015.

Tax Compliance - Small Business Concessions (inc 20k Full Depreciation and the General SBE Pool for Depreciation)

As announced by the Australian Government as part of the 2016/17 Budget the existing Small Business Entity arrangements have been extended to businesses with 10 million in turnover (prev. 2 million). AssetManager Pro 2016 (v5) supports that through:

1. Ability to define your business as an Small Business Entity (or Non-Small Business Entity)

2. Ability to move from a Non-Small Business Entity to a Small Business Entity

3. Ongoing support for the 20k Full Depreciation Threshold available to Small Business Entities

4. Ongoing support for the Simplified Depreciation Rules available to Small Business Entities including the Small Business Pool which allows the depreciation of all assets at 15% in the first year and 30% for all subsequent years (Click here for detailed information on Small Business Pools).

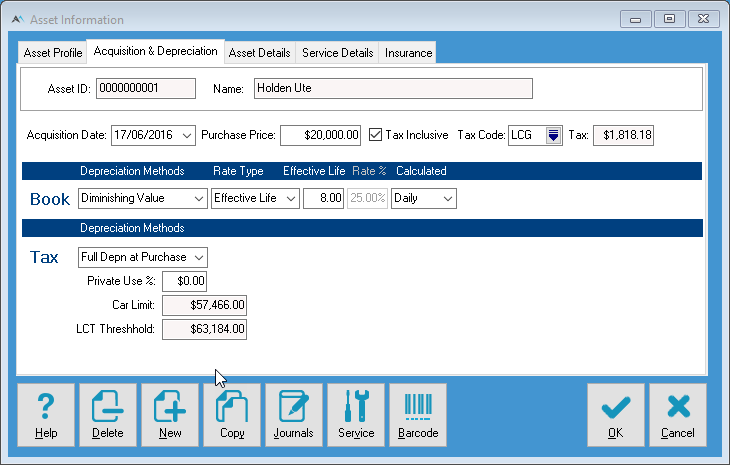

Tax Compliance - Updated Luxury Car Tax Thresholds 2016-17

AssetManager Pro automates the calculation and accounting where Luxury Car Tax applies to a Motor Vehicle (including applying the specific thresholds for Fuel Efficient Vehicles)

In 2016-17 the LCT threshold is changing to

$64,132 (down from $63,184 for 15-16) for Non-Fuel Efficient Vehicles

$75,526 (up from $75,375 for 15-16) for Fuel Efficient Vehicles

For detailed info on yearly thresholds and which AssetManager Pro versions supports those - click here.

Tax Compliance - Updated Motor Vehicle Depreciation Limits 2016-17

For Tax purposes the ATO limits the value to which you can depreciate a Motor Vehicle on - these are known as the Car Depreciation Cost Limits

In 2016-17 the Car Depreciation Limit is changing to $57,581 (up from $57,466 in 2015-16)

For detailed info on yearly thresholds and which AssetManager Pro versions supports those - click here.

Enhancements

In summary:

- Full support for Windows 10

- Asset Insurance (Insurance Policies, Insured Assets and Insured Value vs Asset Values)

- New Formatted Excel Reports for Asset Depreciation by Asset Group (Level 1), Asset Depreciation by Card Level 1 and 2, Asset Depreciation Journal and Trial Balance Reports

- Batch and Enhanced Asset Copy function

- Asset Depreciation Freeze

- Second Element Cost Reduction Asset Transaction.

- Revalue Date/Amount on Asset Depreciation by Asset Depreciation by Asset Group and Card reports

- Asset Depreciation Journals by Asset Groups (splits even if same accounts)

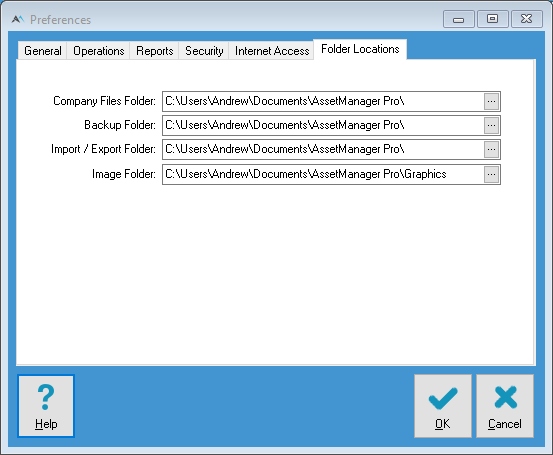

- Default Locations for Company Files, Backup Files, Import/Export Files and Asset Pictures.

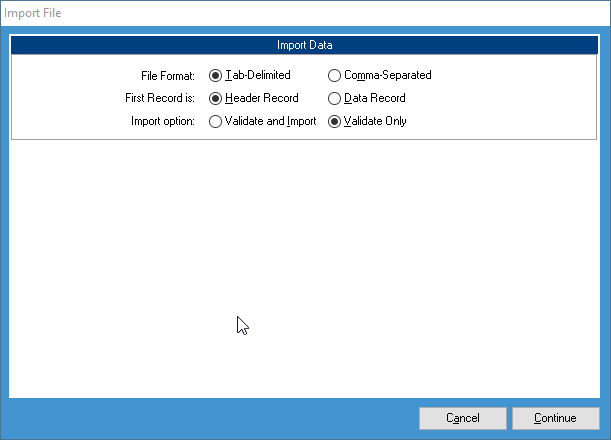

- Pre-Import Error/Warning Validation

This adds to a range of enhancements in AssetManager Pro 2015 (v4) including:

- Support for Windows 7 and 8

- Support for MS Server (via the Enterprise Edition)

- Support for Touch Screens

- Compliance (Range of changes to Full Depreciation Thresholds, Accelerated Motor Vehicle Depreciation, Motor Vehicle Cost Limits and Luxury Car Tax thresholds.

- Enhanced Excel Outputs (Asset Depreciation by Asset Group, Card and Service Reports)

- Asset Depreciation by Month Report

- Ability to enter/import Historical Assets into current year files.

- Direct migration services from MYOB AssetManager v1 and MYOB AssetManager v2

Windows 10 support

On top of the enhancements in v4 to support Windows 7, 8 and MS Server - v5 adds support for Windows 10.

Asset Insurance

A major new function around the management of Insurance Policies and related Asset Insurance. Features will include:

- Create and Manage Insurance Polices

- Link Assets to Insurance Policies

- Report on Insured Amounts vs. Asset Cost and Current Value (Summary and Detail)

- Manage Insurance Renewals through the new Insurance To Do List.

Enhanced Excel Outputs

As part of AssetManager Pro 2015 (v4) was released some new excel outputs providing much improved formatted outputs - making it easy to conduct further analysis in excel (filtering, sorting, formulas etc). Where applicable these replaced the existing Disk button outputs.

in 2015 (v4) reports supported included the Asset Depreciation by Asset Group Level 2, Asset Depreciation by Card Level 3, Asset Transactions, Service Due and Service Logs reports

2016 (v5) adds the enhanced excel outputs to the following reports

- Asset Depreciation by Asset Group Level 1

- Asset Depreciation by Card Level 1 and 2

- Depreciation Journal

- Trial Balance Reports

Enhanced (and Batch) Copy Assets

In previous version of AssetManager Pro you could copy an asset to create a new single asset.

But what if you had purchased multiple similar assets and wanted to add them all quickly into AssetManager Pro.

The new Copy Asset function enables the ability to create a copy for multiple assets and further enhances that process through the ability to:

1. Select which fields get copied (that includes fields relating to the Profile, Acquisition, Depreciation, Card, Warranty, Service and Insurance details)

2. Automate the Asset ID setting, with the ability to indicate if the Asset ID should be incremented based on the Default, be Incremented or append the Asset ID with a counter

3. Automate the Asset Name setting, with the ability to append the Asset Name with a counter or the asset ID.

4. Automate the Serial Number, with the ability to increment the Serial Number for each copy created.

Freeze Depreciation Transaction

Designed for many of our clients who use AssetManager Pro to manage residential and commercial properties, the Freeze Depreciation feature enables depreciation to be freezed for a period of time when the asset is not generating income for a period of time.

Company File, Backup, Import/Export, Asset Picture Default Locations

Make it easier to locate and access files centrally with default locations for your Company File(s), Backups and Import and Export files.

Centrally locate and access Asset Pictures (Images) providing support for centrally located (server based) files ensuring all users will see pictures uploaded against assets by other users.

Second Element Cost REDUCTION Transaction (Now Cost Adjustment)

AssetManager Pro currently supports what is known as a Second Element Cost transaction. This is a tax related transaction that enables the addition of incremental costs to an asset that are directly relating to it.

The NEW Cost Adjustment transaction enables an asset to have a value reduced where that reduction is in effect a disposal of part of the asset.

Revalue Date/Amount on Asset Depreciation Excel Outputs

If an Asset has been revalued (which is shown when you display/print an Asset Depreciation by Group or Card report) this will now also show on the relevant Excel Outputs for that report

Depreciation Journals by Asset Groups

Currently if you have multiple asset groups that are assigned the same General Ledger accounts - the Depreciation Journal report would consolidate the journals.

Related Articles

AssetManager Pro 2018 v7 Release Info

Overview Information on the GRAGA AssetManager Pro 2018 (v7) upgrade. AssetManager Pro 2018 Upgrading from MYOB AssetManager Pro? If you are a current MYOB AssetManager or MYOB AssetManager Pro user you will find a lot has changed with AssetManager ...AssetManager Pro 2019 v8 Release Info

Overview Information on the AssetManager Pro 2019 (v8) Release. AssetManager Pro 2019 Upgrading from MYOB AssetManager Pro? If you are a current MYOB AssetManager or MYOB AssetManager Pro user you will find a lot has changed with AssetManager Pro! ...AssetManager Pro - Back Home!

GRAGA Software Solutions and MYOB AssetManager Pro In 1996 MYOB commissioned GRAGA Software Solutions to develop what was later to be called MYOB AssetManager. Over the past 18 years GRAGA continued to develop MYOB AssetManager and MYOB AssetManager ...Using Xero with AssetManager Pro

Overview AssetManager Pro has been designed to integrate into a range of popular Accounting systems including MYOB AccountRight, Reckon Accounts, Intuit QuickBooks Online and Xero via the generation of a journal import file that is exported from ...AssetManager Pro 2017 (v6) Release Info

Overview Information on the GRAGA AssetManager Pro 2017 (v6) upgrade. AssetManager Pro in 2017 Upgrading from MYOB AssetManager Pro? If you are a current MYOB AssetManager or MYOB AssetManager Pro user you will find a lot has changed with ...