Setting and Calculating Luxury Car Tax in AssetManager Pro

Overview

AssetManager Pro automates the calculation and accounting of Asset Purchases/Acquisitions where Luxury Car Tax applies to a Motor Vehicle (including applying the specific thresholds for Fuel Efficient Vehicles)

Related Articles

- AssetManager Pro 2015 (v4) LCT Threshold Updates

- AssetManager Pro 2016 (v5) LCT Thresholds Updates

- AssetManager Pro LCT Threshold Tables

- AssetManager Pro LCT Calculations and Formulas

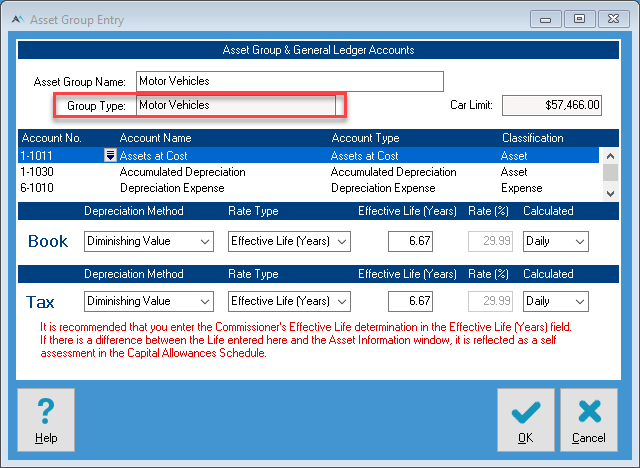

Based on Assets set against Asset Groups - Motor Vehicle

You will see the the LCT options and thresholds when adding a asset that is assigned to a Asset Group of type Motor Vehicle.

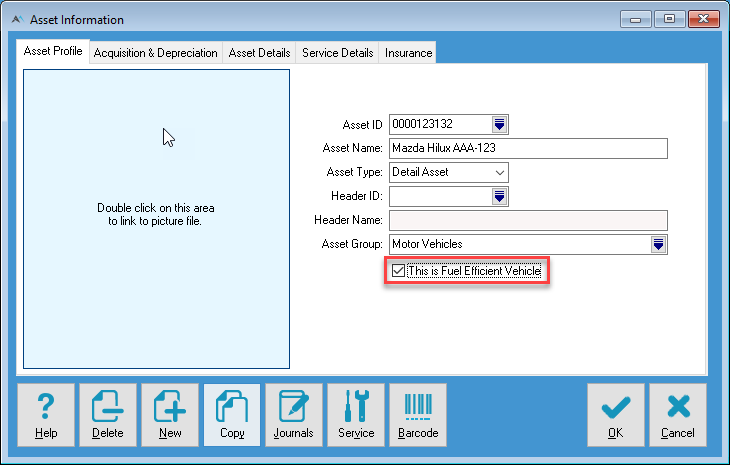

Fuel Efficient Vehicles

If the asset is Fuel Efficient you can indicate that when entering/editing an Asset in the Asset Profile.

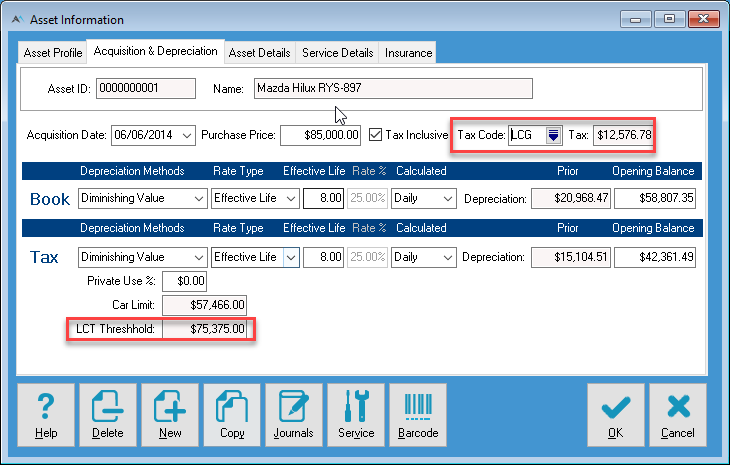

Applied LCT Threshold and Tax Calculation

In the Acquisition and Depreciation tab if the Acquisition Cost exceeds the Threshold it will display that threshold and if a Tax Code that includes Luxury Car Tax is applies that threshold will be used in the calculation of LCT.

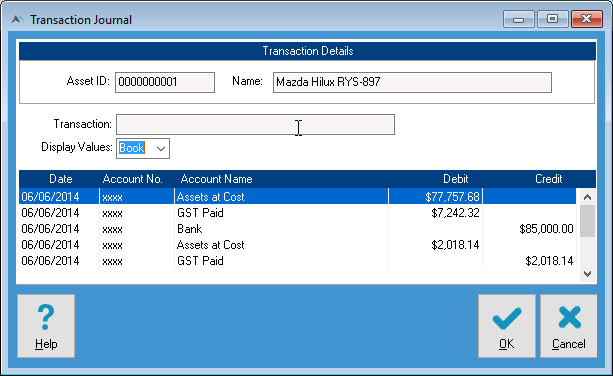

Accounting for LCT

With the LCT Threshold applying and the appropriate LCT tax code applied - AssetManager Pro then provides the journal that can be entered into the Accounting system to reflect the Acquisition and the coding for LCT

Related Articles

AssetManager Pro - Luxury Car Tax

How is Luxury Car Tax (LCT) calculated in AssetManager Pro? Where a vehicle exceeds a certain cost, it is subject to Luxury Car Tax (LCT). There are various provisions which apply to the calculation of LCT and the claimable depreciation on such ...AssetManager Pro - Luxury Car Tax Thresholds

Overview Where a vehicle exceeds a certain cost in Australia, it is subject to Luxury Car Tax (LCT). There are various provisions which apply to the calculation of LCT and the claimable depreciation on such vehicles. This support note explains these ...AssetManager Pro - Back Home!

GRAGA Software Solutions and MYOB AssetManager Pro In 1996 MYOB commissioned GRAGA Software Solutions to develop what was later to be called MYOB AssetManager. Over the past 18 years GRAGA continued to develop MYOB AssetManager and MYOB AssetManager ...Using Xero with AssetManager Pro

Overview AssetManager Pro has been designed to integrate into a range of popular Accounting systems including MYOB AccountRight, Reckon Accounts, Intuit QuickBooks Online and Xero via the generation of a journal import file that is exported from ...Setting passwords

You can safeguard your company's data by setting up passwords to prevent people from using parts of the data file that they don't need to use. This ensures that only authorised staff have access to your confidential information. You can use the ...